Unveiling India's AI Landscape: Startups and GCCs Lead in GenAI Adoption

Unveiling India's AI Landscape: Startups and GCCs Lead in GenAI Adoption

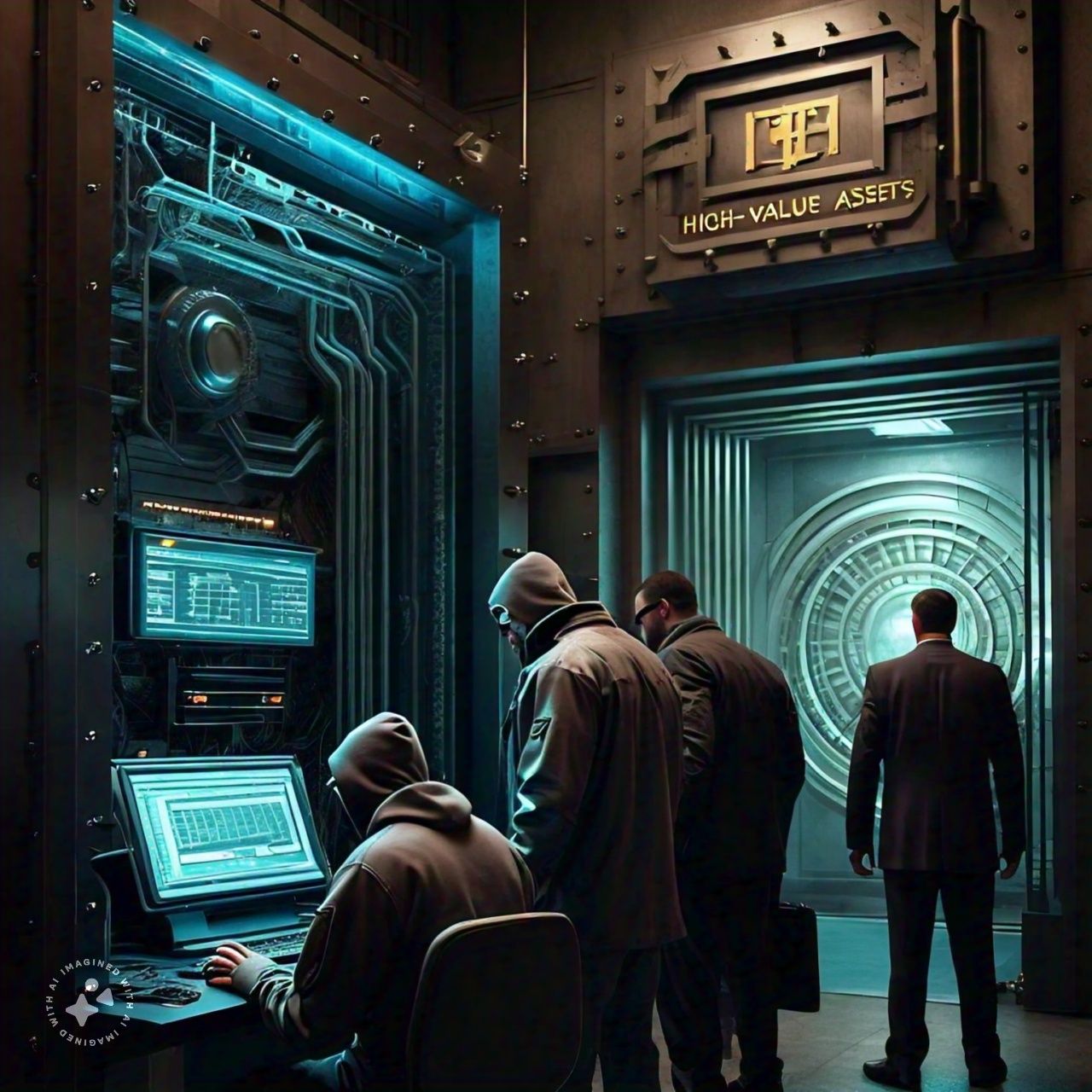

Unveiling the AI Dilemma: Financial Crime's New Frontier

In a groundbreaking survey conducted by BioCatch, the pioneering authority in digital fraud detection and financial crime prevention, alarming statistics emerge: nearly 70% of fraud-management, anti-money laundering, and risk and compliance professionals acknowledge the superior adeptness of criminals in exploiting artificial intelligence for financial misconduct compared to banks' utilization of AI to thwart such activities.

Released today, the inaugural AI-focused fraud and financial crime report unveils a disquieting trend where even individuals with limited technical prowess harness AI to elevate the sophistication, scope, and efficacy of digital-banking frauds and financial schemes.

According to Tom Peacock, BioCatch's Director of Global Fraud Intelligence, "Artificial intelligence can supercharge every scam on the planet," customizing scams to each victim by seamlessly adapting language, slang, and multimedia elements. This evolution necessitates financial institutions to embrace innovative strategies and technologies to safeguard their clientele.

A striking revelation from the survey indicates that 91% of organizations are reconsidering voice verification for major clients due to AI's capability in voice cloning. Additionally, over 70% of respondents observed the utilization of synthetic identities during client onboarding, a phenomenon alarmingly under-detected by traditional fraud models, with the Federal Reserve identifying synthetic identity fraud as the fastest-growing financial crime in the U.S., incurring substantial losses annually.

Jonathan Daly, BioCatch's CMO, emphasizes the imperative for new authentication paradigms in the AI era, advocating for behavioral intent signals as the novel authentication senses, crucial for real-time detection of deepfakes and voice clones to preserve individuals' assets.

Key insights from the survey highlight the pervasive impact of AI on financial institutions, with over half reporting losses ranging from $5 to $25 million to AI-driven attacks in 2023. Moreover, nearly three-quarters of respondents affirm their organizations' use of AI in fraud detection, attributing AI with significantly enhancing response speed to potential threats.

An urgent call for collaboration resounds through the findings, with over 40% of companies managing fraud and financial crime independently, underscoring the necessity for cohesive efforts. Nearly 90% of respondents advocate for enhanced information sharing between financial institutions and government entities to combat the escalating threat of financial crime.

Looking ahead, the survey anticipates widespread adoption of AI in facilitating intelligence-sharing about high-risk individuals among disparate banks in the imminent future, underscoring the pivotal role of AI in fortifying collective defense mechanisms against financial malfeasance.

As the digital landscape evolves, the imperative to harness AI ethically and innovatively becomes paramount in safeguarding financial ecosystems against ever-evolving threats, heralding a new era of vigilance and collaboration in combating financial crime.

In the realm of contained writing, I am a quiet observer, an architect of words, and a weaver of emotions. With ink and paper, I build worlds, share secrets, and unlock the mysteries of the human heart.

Unveiling India's AI Landscape: Startups and GCCs Lead in GenAI Adoption

Apple CEO Tim Cook Applauds India's Thriving Developer Community and Strategic Significance in Global Tech Landscape

Revolutionizing Tablet Experience: Apple's 2024 iPad Pro Lineup Unveiled